Lake county tax rate 7 25 previously 7 00 note. Sales tax rates can be found by entering an address into the search box or clicking anywhere on the map.

State And Local Sales Tax Rates 2019 Tax Foundation

State And Local Sales Tax Rates 2019 Tax Foundation

Choose any state for more information including local and municiple sales.

Sales tax by state map

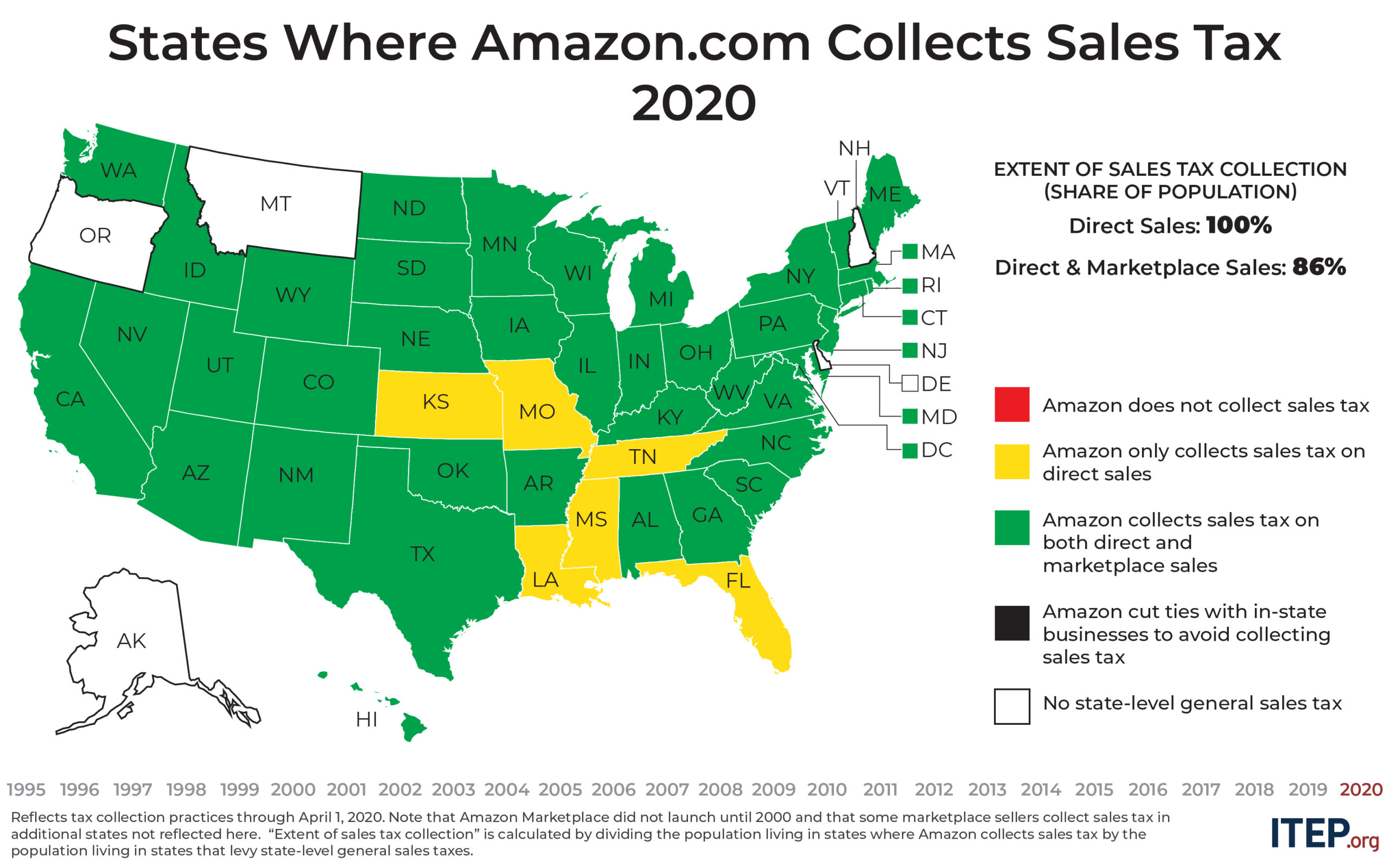

. Individual state and local sales tax information provided by taxjar. California has the highest state level sales tax rate at 7 25 percent. Compare state tax rates and rules on income ordinary purchases gas sin products property and more across the u s. Sales taxes in the united states are administered on a state level in all but the five states with no state sales tax as well as locally by counties and cities in the 37 states that allow municipal governments to collect their own local option sales taxes this means that sales taxes can be quite complicated and a simple map of state sales tax rates doesn t cut it as a method of visualizing.The interactive map was. Clicking on any state name on the right will provide you with links to various contacts within that state information relating to that state s tax rates a link to the state s sales tax rate lookup application if applicable and information for remote sellers. Many states allow local governments to charge a local sales tax in addition to the statewide sales tax so the actual sales tax rate may vary by locality within each state. State sales tax map.

Click a state name to get helpful sales tax info. Indiana mississippi rhode island and tennessee. The lowest non zero state level sales tax is in colorado which has a rate of 2 9 percent. Hover over or click on any state in the map for the option to add the.

Total state and local sales tax rates total state and local sales tax rates by county by county effective april 1 2020effective april 1 2020 number of counties 1 2 56 13 13 3 rate new rate. Four states tie for the second highest statewide rate at 7 percent. Solutions by role. See what states are tax liens or tax deeds.

This table and the map above display the base statewide sales tax for each of the fifty states. Launched in november 2018 revenue s sales tax rate map is an interactive application that helps customers easily find and calculate the state and local general sales and use tax rate for any location in minnesota. 50 state tax sale map and breakdown includes auction type auction dates interest rates redemption periods. Small portions of delaware fairfield licking union counties assess.

Product how it works api autofile sales tax nexus sales tax reporting.

Sales Tax By State Here S How Much You Re Really Paying

Sales Tax By State Here S How Much You Re Really Paying

States With The Highest And Lowest Sales Taxes

States With The Highest And Lowest Sales Taxes

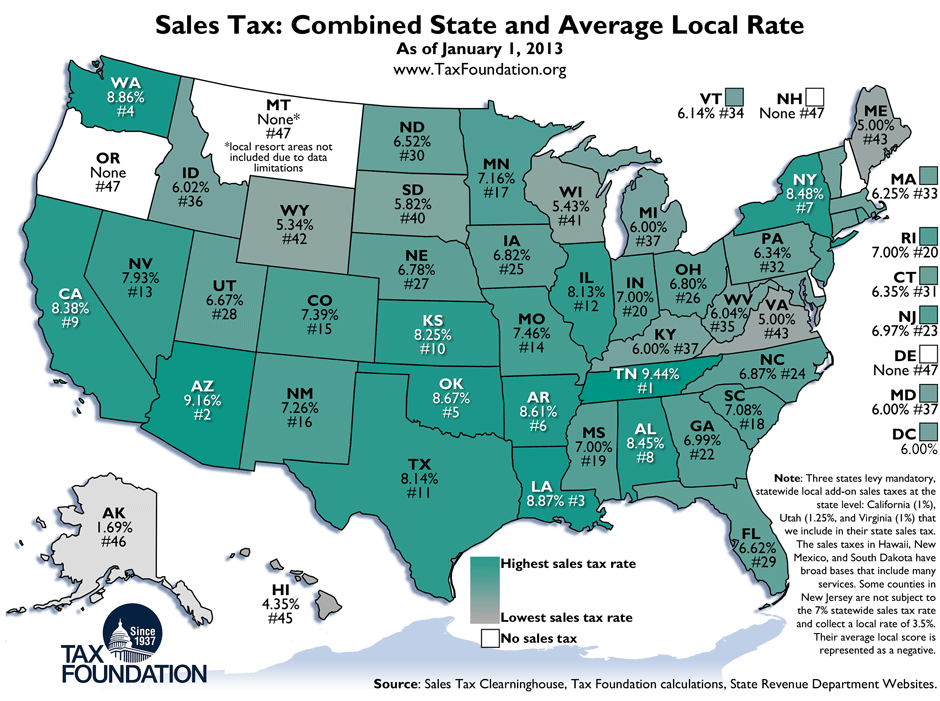

Weekly Map State And Local Sales Tax Rates 2013 Tax Foundation

Weekly Map State And Local Sales Tax Rates 2013 Tax Foundation

Best Worst Sales Tax Codes In The U S Tax Foundation

Best Worst Sales Tax Codes In The U S Tax Foundation

Monday Map State Sales Tax Rates American Enterprise Institute

Monday Map State Sales Tax Rates American Enterprise Institute

State Sales Tax To What Extent Does Your State Rely On Sales Taxes

State Sales Tax To What Extent Does Your State Rely On Sales Taxes

Map State Sales Taxes And Clothing Exemptions Trip Planning

Map State Sales Taxes And Clothing Exemptions Trip Planning

The United States Of Sales Tax In One Map The Washington Post

The United States Of Sales Tax In One Map The Washington Post

0 comments:

Post a Comment